BCI - Made in France 2025 – Hosted by Bryan, Garnier & Co

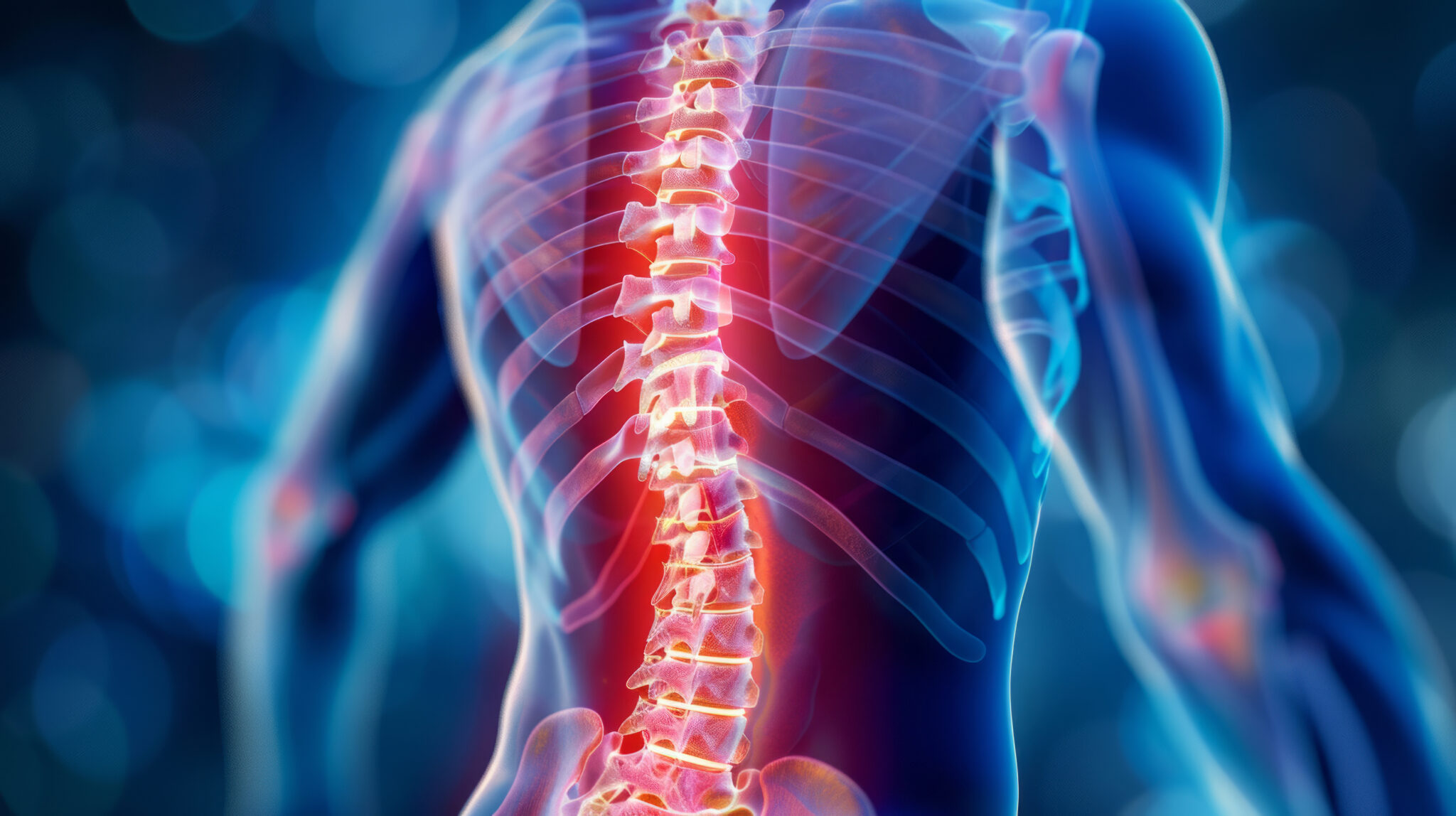

Together with ONWARD Medical Co-Founders, Bryan, Garnier & Co hosted an exclusive Brain-Computer Interface (BCI) event on Thursday, 24 April 2025, at our Paris headquarters.

The event brought together a select group of institutional investors for a roundtable discussion with ONWARD Medical’s co-founders, Prof. Grégoire Courtine, Neuroscientist, Co-Founder and Scientific Advisor at ONWARD Medical and Dr. Jocelyne Bloch, Neurosurgeon, Co-Founder and Medical Advisor at ONWARD Medical, to explore the transition from neuroscience research to entrepreneurship, with a deep dive into the emerging frontier of neurotechnology: BCI.

The session opened with remarks from Bryan, Garnier & Co highlighting the fast-evolving BCI space, its nascent commercial landscape, and the transformative potential for healthcare. This was followed by a candid and forward-looking conversation with ONWARD Medical’s founders, who shared their journey, their vision, and the groundbreaking developments behind their ARC-BCI platform — a therapeutic system designed to restore movement by bridging the brain directly to the spinal cord.

ARC-BCI is set to be a revolutionary therapeutic device, whose secret sauce — as commented by the speakers — lies in the development of a brainGPT, aimed at empowering ARC-IM’s therapeutic potential by bridging to human thoughts.

ONWARD Medical (Euronext: ONWD; US OTCQX ONWRY) is a medical technology company creating therapies to restore movement, function, and independence in people with spinal cord injury (SCI) and movement disabilities. Building on more than a decade of science and preclinical research conducted at leading neuroscience laboratories, the Company has received ten Breakthrough Device Designations from the US Food and Drug Administration for its ARC Therapy™ platform.

The Next Launch Window: What It Means for Satcoms

PARIS | 24th March 2025 – BG IRIS, Bryan Garnier’s research platform, is pleased to release The Next Launch Window, an in-depth analysis of the changing landscape of space launches and satellite communications.

New super-heavy-lift rockets are set to transform the economics of space travel. These powerful vehicles could accelerate the rise of large satellite constellations, making them even more dominant in satellite communications. Meanwhile, in Europe, a new generation of space start-ups is challenging the established players. A major shift is underway:

-

The launch market is splitting into two segments: large super-heavy-lift rockets for massive deployments and smaller, flexible launchers for specialised and national security missions.

-

Europe is witnessing a new space race, with next-generation launchers in development and front-runners like Isar Aerospace, MaiaSpace, Orbex, PLD Space, and RFA nearing their maiden flights.

-

Medium launch vehicles stand out as the “Goldilocks” option, serving a large market while avoiding direct competition with SpaceX and Blue Origin.

At the same time, the rapid expansion of mega-constellations is reshaping the competitive landscape for satellite operators. The unprecedented launch capacity of next-generation rockets could further strengthen the dominance of major players. However, shifting defence priorities in the U.S. and Europe may open new opportunities for incumbent satellite providers. As European governments focus on secure, sovereign satellite networks, initiatives could gain traction, positioning regional operators as strategic alternatives to the dominant global constellations.

To learn more about these industry trends and what they mean for the future of satellite communications and space launches, download the industry brief.

Energy-Aware AI: Confronting the power-hungry reality of scaling AI

PARIS | February 20th, 2025 – BG IRIS, Bryan Garnier’s research platform, is pleased to release “Energy-Aware AI: Confronting the power-hungry reality of scaling AI”, an in-depth analysis exploring the impact of AI on data center infrastructure and energy consumption.

As generative AI fuels an unprecedented surge in compute demand, data centers designs are evolving to handle soaring power densities and thermal needs of AI servers. With data center electricity consumption set to double by 2030, we explore the strategies and innovations that can enable the industry to scale sustainably.

- The AI era is triggering a seismic shift in global capex priorities, with data centres poised to attract nearly USD500bn in 2025 alone.

- AI is turning data centers into power-hungry giants, with their electricity consumption set to exceed 1000TWh by 2030, putting pressure on energy systems.

The AI-driven investment cycle is reshaping dynamics for electrical and thermal system suppliers, as the demands of accelerated computing drive convergence between IT equipment and infrastructure (power and cooling).

In response, the industry is seeing rapid advancements in advanced cooling, high-efficiency power systems, and energy management solutions. Policymakers and enterprises alike are seeking pathways to balance innovation with sustainability, shaping the future of AI infrastructure.

To dive deep into this topic and discover more about the emerging technologies and strategies shaping sustainable AI infrastructure, download the industry brief.

Martin Eichler's story: Investment Banking Director

We sat down with Martin, Investment Banking Director in our Munich office to discuss his five years at Bryan, Garnier & Co.

You’ve been at Bryan, Garnier & Co for the last five years. Can you tell us what initially attracted you to the company, and how your journey began?

I joined Bryan, Garnier & Co in early 2020 as a Vice President in the tech team. Before that, I worked at a tech and healthcare-focused boutique that primarily served the DACH region. I was looking for a more international setup, but one that still retained the boutique feel. Bryan, Garnier & Co ticked those boxes, offering an international brand with the right focus areas, especially in tech, which has always been my passion. It felt like a natural next step in my career.

Over the past almost five years, how have your roles and responsibilities evolved, and how has this contributed to your personal and professional growth?

When I first started, my work was heavily execution-focused, handling day-to-day tasks related to transactions. As I gained more experience, I transitioned into a more client-facing role, taking on greater responsibility not only within the team but also within the sector. My role has expanded into origination, as well as staff recruitment and management. I’ve also taken on a people management role, both within the office and on transactions. Over time, my responsibilities have grown to encompass both client management and mentoring younger team members.

Persistence, focus, and excellent interpersonal skills are key to making things work smoothly.

What makes Bryan, Garnier & Co stand out compared to other companies?

It’s the entrepreneurial spirit here. We have an international yet close-knit setup with flat hierarchies, which means you can approach anyone for advice or support. It’s quite different from larger banks or even smaller firms where that level of openness isn’t as common. If you find a niche that’s underdeveloped and put in the effort, you can quickly grow and establish something meaningful. This freedom to build within the firm is one of the things that makes Bryan, Garnier & Co unique.

Could you share a memorable deal that you’ve been involved in during your time here?

I would say there is no specific transaction, but one deal that comes to my mind was about a global IT services company. It was a founder-led business with strong operations in India, and the founders were a group of four young entrepreneurs, all around in their mid-30s. The dynamic within the team was unique and despite the challenges, the transaction was a success for both the client and the firm. It’s these kinds of international, high-energy deals that make my job exciting.

What are some of the everyday challenges you face in your work, and what qualities are essential to handle them?

Every transaction is unique, from the people involved to the process itself. The most challenging part is aligning all the stakeholders – whether it’s investors, management, or others – so that everyone is working toward the same goal. You have to be a strong people manager and process manager to bring it all together. Of course, understanding the technical aspects of the deal is crucial, but managing personalities and expectations is where the real complexity lies. Persistence, focus, and excellent interpersonal skills are key to making things work smoothly.

What do you think is the most critical quality for success in investment banking?

Persistence and client focus are essential. It’s about striving for quality at every stage and making sure you’re consistently delivering the best outcomes for your clients. You also need to be adaptable and have strong time management skills. Over time, the focus shifts from purely technical work to managing people and relationships, which requires a different set of skills.

It’s about striving for quality at every stage and making sure you’re consistently delivering the best outcomes for your clients.

Tech Tour announces 2025 edition of the Tech Tour Growth50 List

Bryan Garnier is proud to once again partner with Tech Tour for the 2025 edition of the Tech Tour Growth50 Europe Summit, taking place in Paris on March 4th. The event will highlight 50 of Europe’s most promising companies with the greatest growth potential in the digital, health, and sustainability sectors.

Tech Tour has officially unveiled the 2025 edition of the Tech Tour Growth50 List, which identifies Europe’s leading tech companies, many of which are on track to become Europe’s next industry leaders.

This year’s list showcases the growing prominence of deep tech, reflecting investor confidence in technology-driven sectors such as quantum computing, AI for health, photonics, biotech, green energy, and climate tech.

To learn more about the event and see the full list of Growth50 companies, visit the Tech Tour website.

BG Insight Series – Aidon and Alder

bethsabee gresse

BG Insight Series - Aidon and Alder

Welcome to Bryan Garnier’s Insights Series, where we explore key trends shaping the future of energy, technology, and healthcare. In this edition, we dive into the smart grid sector with insights from Tommi Blomberg, CEO of Aidon, and Henrik Flygar, Partner at Alder, Aidon’s former majority shareholder.

Aidon is at the forefront of this revolution, delivering advanced smart metering solutions that empower utilities to meet the demands of a rapidly changing energy landscape. As Tommi Blomberg explains: “Smart grids are critical for enabling the shift to sustainable energy by optimising energy efficiency, enhancing grid reliability, and integrating renewable sources seamlessly.”

The push toward decarbonisation has created a pressing need for smarter, more resilient grids. Henrik Flygar highlights the potential: “With growing energy demands and a strong focus on sustainability, the smart grid sector offers immense potential for innovation and investment. From cutting-edge technologies to favourable government policies, the industry is ripe for growth.”

Aidon’s solutions are helping utilities unlock the power of real-time data, predictive maintenance, and advanced analytics, ensuring the grid can adapt to evolving needs.

Recently, Aidon joined forces with Gridspertise, marking a significant milestone in the company’s journey. This partnership combines Aidon’s expertise in smart metering with Gridspertise’s global reach, opening new doors for expansion in both established and emerging markets.

Reflecting on this move, Tommi Blomberg shares: “This partnership allows us to scale faster and deliver even greater value to our customers, all while driving innovation in the energy sector. Bryan Garnier’s support was invaluable throughout this process.”

As the energy sector continues to evolve, the role of smart grids will only grow in importance. From integrating renewable energy to enhancing grid stability, companies like Aidon are tiling the way for a sustainable energy future.

Bryan Garnier remains committed to supporting innovators driving the future of energy and sustainability. Join us in this episode as we uncover the transformative impact of smart grids with Tommi Blomberg, CEO of Aidon, and Henrik Flygar from Alder.

Get in touch

Whether you’re at the outset seeking funding, or an established firm searching for strategic options, our team will provide you with tailored advice to help you reach your goals.

Our transactions

Bryan, Garnier & Co offers a complete range of investment banking services, from growth financing to mergers and acquisitions.

Venture Meets Secondaries

Are Secondaries Reshaping the Future of Venture Capital?

Join Bryan Garnier & Co in collaboration with POELLATH for an exclusive evening in Munich that delves into the transformative role of secondaries in the venture capital landscape. This event offers a unique opportunity to gain expert insights, engage with thought leaders, and network with industry pioneers.

Taking place on Thursday, 20th of February 2025, this exclusive event will bring together high-profile investors, venture capital experts, and industry leaders for an in-depth exploration of secondaries and their growing impact on the market.

Why attend?

This event is designed for professionals eager to deepen their understanding of the secondary market and its implications for venture capital and growth equity.

You will:

- Access Exclusive Data: Learn from our specialists who will share actionable insights, successful use cases, and in-depth market dynamics.

- Master Best Practices: Explore advanced strategies for company-led secondaries, from risk management to valuation techniques and market trends.

- Engage with Experts: Connect directly with VC secondary professionals for tailored advice and personalised insights.

Don’t Miss This Exclusive Opportunity

The secondaries market is reshaping the way venture capital operates, providing new avenues for liquidity and growth. Be part of this transformative discussion and gain a competitive edge in navigating these changes.

Reserve Your Spot Today

To secure your place at this exclusive event, register your interest below. A member of our team will confirm your participation shortly.

We look forward to welcoming you to an unforgettable evening of insights and connections in Munich.

Our speakers panel

Bryan, Garnier & Co joins forces with Stifel

ST. LOUIS & PARIS, January 6, 2025 – Stifel Financial Corp. (NYSE: SF) today announced it has signed a definitive agreement to acquire Bryan, Garnier & Co. (“Bryan Garnier”), a leading independent full-service investment bank focused on European technology and healthcare companies. Terms of the transaction were not disclosed.

Founded in 1996, Bryan Garnier’s product suite includes mergers & acquisitions advisory, private and public growth financing solutions and institutional sales & execution. With a team of approximately 200 professionals, including 33 Managing Directors, Bryan Garnier is headquartered in London and has offices in Paris, Amsterdam, Munich, Oslo, Stockholm, and New York.

“As a leading European middle market investment bank in the healthcare and technology verticals, Bryan Garnier represents an ideal partner,” said Ronald J. Kruszewski, Stifel Chairman and CEO. “Its culture and long-term history of providing clients with high quality advice in two of our largest investment banking growth verticals is highly complementary with Stifel’s business. This combination is a logical next step in the evolution of Stifel’s global advisory business.”

“By integrating Stifel’s capabilities across advisory, private and public markets, and equity and debt solutions, Stifel and Bryan Garnier are offering unparalleled opportunities for clients, employees, and the European market as a whole,” said Olivier Garnier, co-founder and Managing Partner of Bryan Garnier.

Over the years, Stifel has grown both organically and through acquisition, and is on pace to generate more than $4.8 billion in net revenue in 2024.* With nearly 10,000 professionals located across approximately 400 offices across the United States, Europe, the Middle East, and Asia, Stifel is a leading M&A advisor and a premier capital markets firm. Stifel was named “US Mid-Market Equity House of the Year” by International Financing Review (IFR), recognizing outstanding capital markets achievements in 2023.

Keefe, Bruyette & Woods, A Stifel Company, acted as exclusive financial advisor and Bryan Cave Leighton Paisner LLP acted as legal advisor to Stifel in the transaction. Houlihan Lokey acted as exclusive financial advisor and White & Case LLP acted as legal advisor to Bryan Garnier.

The acquisition is subject to approval by the UK and French regulators.

The Optical Industry with Cédric Rossi, BG IRIS Analyst at Bryan, Garnier & Co

In 2024, the optical sector continues to evolve, driven by innovative strategies and diversification toward new audiences. In an exclusive interview with “Bien Vu”, Cédric Rossi, analyst in luxury and consumer goods at Bryan Garnier, sheds light on the major movements within the industry and their impact on opticians.

Key points from the interview included:

- The strategic acquisition of Supreme by EssilorLuxottica

- The rise of digital services for opticians

- AI and optimized business models: a game-changer

“Opticians have many cards to play, as there are still numerous unaddressed vision corrections” highlights Cédric Rossi.

Whether it’s appealing to new generations or leveraging the potential of emerging technologies, the optical industry promises to be both dynamic and full of opportunity for years to come.

At Bryan Garnier, we are committed to providing in-depth industry insights, fostering innovation, and guiding companies through transformative changes in their respective markets. Our expertise in sectors like luxury, technology, and consumer goods ensures that we can offer tailored solutions, supporting clients in optimising their strategies and enhancing long-term value.