The Plastic Revival

PARIS | January 11th, 2024 – BG IRIS, Bryan Garnier’s research platform, is pleased to release the “The Plastic Revival”, a comprehensive analysis of the sector as well as underlying financing and M&A market activities.

Plastic was fantastic, but now it has become a major burden as most plastics currently in use are produced from non-renewable resources such as crude oil and natural gas. The annual global production of plastics amounted to 400 million tons in 2022 and is set to reach 750 million tons by 2050, yet only 9% of plastic waste is recycled globally.

For decades, efforts to collect and recycle plastic waste have been economically challenging. However, broad coalitions of players across the plastics value chain are taking actions to address this transgenerational issue. Real growth for sustainable plastics is just about to start and should merely accentuate over the coming years.

Within this white paper, we provide a comprehensive guide to the plastic revolution, unveil emerging regulations, and explore advanced recycling technologies. Our analysis uncovers challenges and expert opinions that will shape the industry’s future.

To dive deep into this topic and discover more about plastic recycling as a transformative industry of the future, download the white paper.

L’AGEFI interview with Antoine Lebourgeois, BG IRIS Analyst at Bryan Garnier

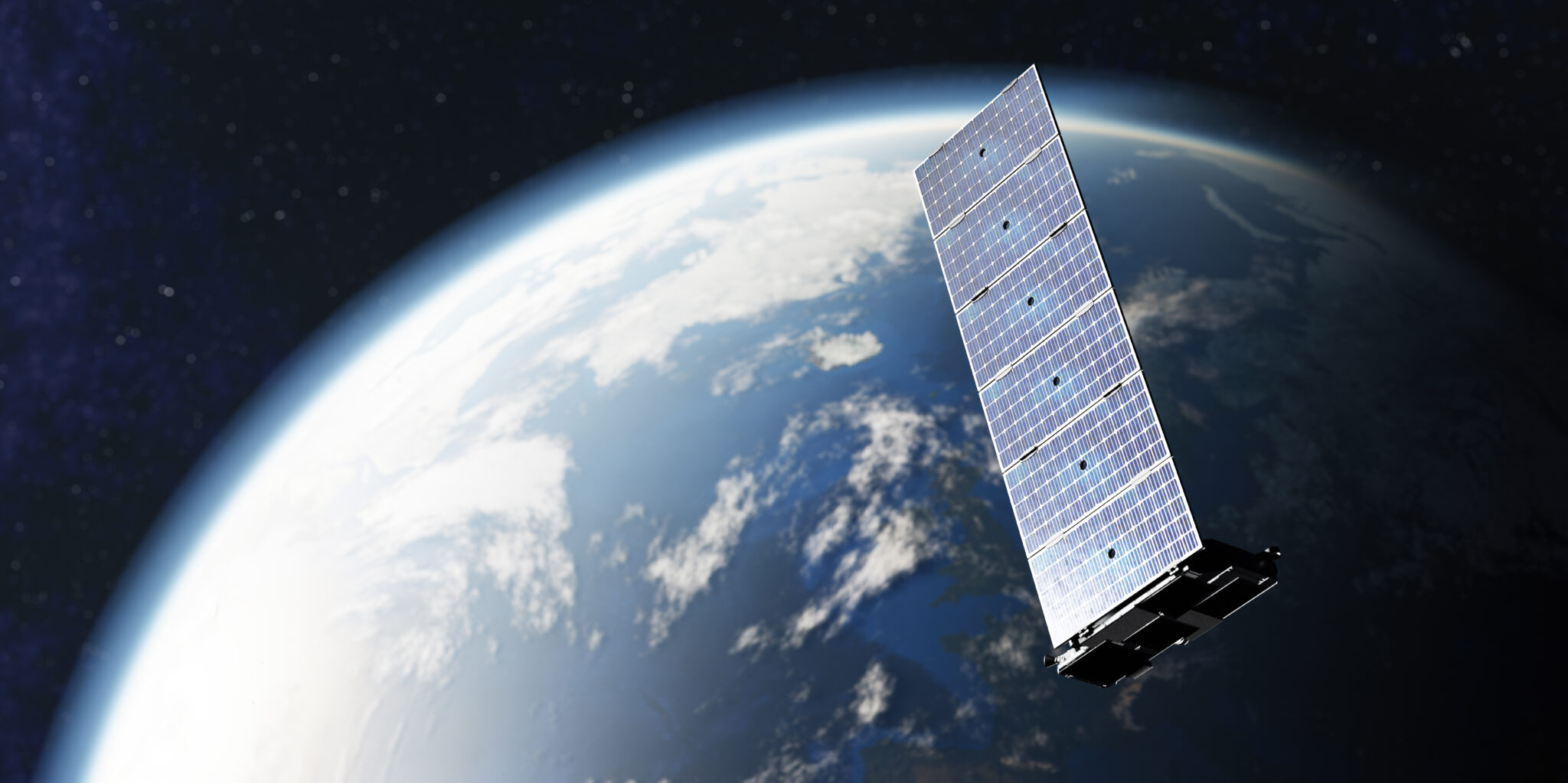

Following an insightful interview with BG IRIS Analyst Antoine Lebourgeois, Capucine Cousin penned an article in L’AGEFI shedding light on Elon Musk’s desire to connect smartphones directly to his Starlink network and the possible implications. In this summary, we capture key points from the interview and provide a link to the full article in French.

Elon Musk wants to revolutionize the telecom sector by connecting smartphones directly to his Starlink network. On Wednesday 3rd January 2024, a SpaceX Falcon rocket delivered a new batch of high-speed satellites.

Is this a threat to traditional telecom operators? Not really.

“Satellite operators like Starlink need access to frequency bands to launch their satellites. This means partnering with telecom operators to access them”, notes BG IRIS Analyst Antoine Lebourgeois. Starlink can’t bypass the telcos – it must be able to use their low-bandwidth frequencies and must get the green light from local telecom regulators.

“For the time being, it’s just a basic service, a sort of emergency service for sending SMS in areas with poor coverage”, continues Antoine Lebourgeois.

To dive deep into this topic and discover the future of the space industry, request the white paper.

The Evolving Landscape of Agency M&A by Sebastian Schirl

In the 100th episode of #WhatsNextAgencies, Kim Alexandra Notz engages in an insightful discussion with Sebastian Schirl, Managing Director at Bryan, Garnier & Co’s Business & Tech-Enabled Practice.

Specializing in the Digital Media industry, Sebastian shares market perspectives and current dynamics that shape the industry’s trajectory.

Providing a clear assessment proves challenging amid current geopolitical and inflationary context, as well as the heightened volatility that is steering a shift towards private placements during adverse market conditions. However, two transformative shifts demand attention: AI and profitability.

Key industry trends: AI, profitability and measurable success

The escalating impact of artificial intelligence (AI) will lead to a paradigm shift, set to fundamentally alter the marketing industry. Before October 2022 and the emergence of OpenAI, the world was vibrant, and everything seemed to be progressing smoothly. Sebastian highlights impressive figures: currently, every second a content asset is generated by AI, and by next year, three out of four content assets will be AI-produced. This transformative shift poses challenges for those engaged in contextual marketing, especially concerning text copy, and presents opportunities for those who focus on leadership in creativity, an area where AI has limitations. The imminent influence of AI on the industry is expected to rearrange the landscape.

Another prominent trend that Sebastian addresses is the surging demand for agencies to exhibit measurability, focusing on performance marketing and data-driven approaches. A paradigmatic shift is evident in the evaluation of agency performance, with profitability taking precedence over conventional growth metrics. Investors, encompassing both strategic and financial realms, now prioritize sustained profitability when contemplating acquisitions.

Sebastian shares insights on actively increasing company value by focusing on transparency, data, and performance. Irrespective of sales intentions, understanding trends, potentials, and growth areas is crucial for agencies to strategically position themselves for the future.

Agencies must become more measurable, emphasizing data and performance. Performance marketing, data-driven approaches, and leveraging First Party Data are becoming crucial for success. Agencies that adapt to these trends and demonstrate profitability will navigate the challenges effectively.

Profitability has become a central focus for investors, with a shift away from solely prioritizing rapid growth. Stable and profitable companies in the digital consultancy and performance sectors are especially sought after. The ability to showcase profitability has become essential for a favorable valuation.

M&A dynamics

The M&A landscape is influenced by these factors, with a trend towards stability and profitability. While uncertainties persist, successful companies can find opportunities, and we anticipate an increase in transaction volume in the coming year.

Investors, both strategic and financial, play a crucial role. In the current climate, stable and middle-market technology companies are more sought after, while large agency holdings are exhibiting more caution in acquisitions. Challengers, often from the technology sector, are becoming more active in the M&A space, driving deals with a focus on technology as a core service element.

As the industry adapts to changing dynamics, maintaining agility is crucial for entrepreneurs, investors, and industry professionals alike. The journey from agency ownership to acquisition is nuanced, requiring an adept understanding of cultural shifts, challenges, and the intricacies of valuation metrics. In this evolving agency landscape, staying informed, adaptable, and well-connected remains paramount for sustained success.

For marketing agencies navigating the evolving landscape, key considerations include embracing data-driven marketing strategies and integrating technology into core services. In the M&A realm, agencies, particularly challengers, are subject to private equity involvement, with strategic and financial buyers approaching deals differently.

Relationship-driven approaches and a focus on EBIT (Earnings Before Interest and Taxes) valuation, often normalized for private, owner-led agencies, are crucial in initiating successful discussions. Factors influencing valuation multiples range from agency performance to service diversification, impacting negotiations with both strategic and financial buyers. Motivations for selling, including a generational shift and business challenges, contribute to the dynamics of agency sales. Looking ahead, agencies must align with market demands, addressing growth challenges and optimizing profitability before considering M&A. Post-sale success hinges on strategic planning, integration execution, and adapting to new corporate structures within larger groups. As the agency landscape continues to evolve, understanding these factors is essential for agencies planning for future growth, M&A, and long-term viability within the industry.

How to navigate the M&A landscape

Embarking on Mergers and Acquisitions (M&A) requires a meticulous approach from marketing agencies. First and foremost, agencies should articulate clear objectives, whether seeking growth, diversification, or an exit strategy. Conducting a comprehensive assessment of the agency’s value, including a SWOT analysis, is crucial. Building strong industry relationships through networking and staying abreast of market trends enhances visibility. Financial health and legal compliance should be prioritized, while showcasing the team’s expertise is essential. Creating a well-organized data room and engaging experienced advisors streamline the process. Thoughtful negotiation, transparent communication, and detailed post-acquisition integration plans contribute to a successful M&A journey.

_________

About the author

Sebastian Schirl is the managing director of Business & Tech-enabled Services at Bryan Garnier & Co

Date published: Dec 12, 2023

For more information, please contact Sebastian Schirl.

15 Award winners with innovative climate and green technology solutions at the Tech Tour Growth Sustainability 2023 in Essen

Bryan Garnier is pleased to partner with Tech Tour at their flagship Growth Sustainability 2023 event held in Essen from 27-29 November. The event showcased 95 of Europe’s most promising companies specializing in climate and green technology solutions. These companies were carefully selected for their growth potential from a pool of over 1,000 applicants. Among them, 15 award winners were selected during the event for their innovation and cutting-edge solutions.

The event featured 45 Program Winners from 7 specialized Tech Tour Programmes in sustainability, chosen by a panel of 400 investors from 250 presenting companies. An additional 50 Growth companies in the energy sector were selected by a panel of 70+ European investors from 150 applications.

Germany led the way with 33 companies, followed by the Netherlands with 11, and both Norway and the UK contributing 7 each. Notable attendees included Falk Mueller-Veerse, Partner & Head of DACH at Bryan Garnier, and Jay Marathe, Managing Director within the Energy Transition & Sustainability Practice at Bryan Garnier, who were present and were part of the jury.

Falk Mueller-Veerse, Partner & Head of DACH at Bryan, Garnier & Co comments: “This year, German companies have led the way with 33 companies out of the 95 selected from a pool of over 1000 applicants. Germany is home to innovative growth companies in climate and green technology solutions that are still flourishing in tumultuous times. Events such as the Tech Tour Growth Sustainability act as growth accelerators to these companies, exposing them to investors who might lead the next rounds of financing they need.”

The event included 15 pitching sessions where Award Winners were selected by over 140 investors. Congratulations to the 15 Award Winners: Strohm, Asperitas, b.fab, BeFC, BuyCo, Dexter Energy Services, JUUNOO NV, Kelpi, Magment, Naco Technologies, NexWafe, renasys, Strohm, Unigy, Woon Duurzaam, and Yeastup.

The Tech Tour Growth Sustainability 2023 was hosted by BRYCK and partnered with esteemed organizations, attracting 300+ participants from 24 countries. The success of the event lies in the interaction and collaboration between companies and investors, reinforcing its role in facilitating investment in technology companies.

Tech Tour, known for connecting tech companies with investors, has facilitated over €20.7 billion in investments in the last 7.5 years. Missed this year’s event? Don’t miss out on the upcoming Tech Tour Growth50 Europe 2024 for another transformative experience! Find out more about the event on the Tech Tour website.

At Bryan, Garnier & Co, we are honoured to be a partner to Tech Tour Growth Sustainability 2023 edition and look forward to celebrating the success of Europe’s most promising tech companies. Learn more about the event on Tech Tour’s post.

BG Growth Series - CARBIOS

bethsabee gresse

Coming Soon

Embark on the remarkable journey of Carbios, a company revolutionising plastic recycling. We sat down with Emmanuel Ladent, CEO, and Philippe Pouletty, founder and president of the board. They’re charting a course to transform the life cycle of PET plastics, attributing value to what was previously deemed as waste.

The 9 million tons of plastic polluting our oceans annually inspired Carbios to give value to the plastic in its pioneering method, which involves exclusive enzymes that break down PET plastics, converting them into 100% recyclable materials, thereby fostering a circular economy for plastics.

Carbios‘ focus isn’t solely on PET plastics; they’re working on providing enzymatic solutions for other types of plastics, leading the way in radical innovation.

Carbios leaders direct key messages for growth entrepreneurs, including the importance of continuous news flow and timing financial markets. Act decisively, propel your mission, and articulate your vision clearly.

The company’s approach underscores the significance of seizing opportunities and maintaining continual progress.

Bryan Garnier has played a pivotal role in supporting Carbios’ mission and successful capital raises, advising Carbios since the outset through 4 successful strategic growth transactions, including the latest €141m capital raise.

Carbios turned a scientific concept into tangible industrial activity within their demonstration plant. Their ambitions extend to establishing bio-recycling plants worldwide within the next decade.

Join us in this episode of the BG Growth Series and witness the evolution of plastic recycling as Carbios spearheads sustainable change.

Get in touch

Whether you’re at the outset seeking funding, or an established firm searching for strategic options, our team will provide you with tailored advice to help you reach your goals.

Our transactions

Bryan, Garnier & Co offers a complete range of investment banking services, from growth financing to mergers and acquisitions.